Africa: New and Changed Reports

The ITW8 Tax Certificate layout has been updated as per the latest requirements from BURS.

It is a requirement to use the new layout for the 2018/2019 tax year end.

The pre-printed stationery did not change but the information printing on the certificate has been updated to align to the plain paper certificate.

The existing ITW8 report on the Botswana Reports Menu has been updated to the new layout.

Before running the report, check and confirm that the report setup is correct.

After confirming the Report Selections, you can continue to run the report. When running the report, additional setup information is required and must be completed to create the certificates with the correct data.

The following fields must be completed:

|

Field |

Description |

|---|---|

|

All Employees |

Select this option if you want to include all employees with YTD+ Gross Income irrespective of whether they paid PAYE or not. |

|

Employees with YTD Tax Amounts |

Select this option if you want to include all employees with YTD+ Gross Income and if they paid PAYE during the year. |

|

Person Responsible |

Type in the name and surname of the person responsible for submitting the ITW8 and ITW10 to BURS |

|

Capacity |

Type in the job title of the person responsible for submitting the ITW8 and ITW10 to BURS. |

|

Company Postal Number |

Enter the company’s postal box or private bag number in this field. Even though this value has been captured on Basic Company Information Screen, the report only requires the box/bag number and no other postal address information. |

|

Pre-Printed |

Select this option if you want to print your Tax Certificates on the pre-printed stationery. |

|

Plain Paper |

Select this option to print the Tax Certificate on plain white A4 paper. It is advisable to use this option to check your certificates first before printing to your pre-printed stationery. |

Once all the selections have been made, you can continue to run the report.

The report will open in MS Excel. You will be prompted to save the submission file and a summary report in a location specified by the user.

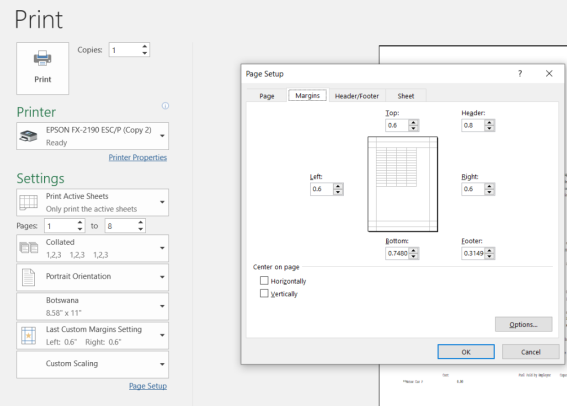

Before printing the Tax Certificates, please take note of the required printer settings to ensure the certificates fit correctly on the stationery you are using.

Pre-Printed Stationery

Plain A4 Paper

The following issues have been resolved or the changes have been made to existing reports and bank files:

|

Country |

Report |

Detail |

|---|---|---|

|

Ghana |

DT0107a Monthly Tax Deduction Schedule |

Other Tax-Deductible values and Other Assessable Income was not included in the report. |

|

Ghana |

DT0108a Annual Tax Deduction Schedule |

Other Tax-Deductible values and Other Assessable Income was not included in the report. |

|

Ghana |

IT51S Form |

Other Tax-Deductible values and Other Assessable Income was not included in the report. |

|

Ghana |

Form 111A & 111B |

Other Tax-Deductible values and Other Assessable Income was not included in the report. |

|

Namibia |

PAYE4 Return Form |

The Person Responsible’ s email address was not displaying correctly when the email address was very long. |

|

Namibia |

Monthly ETX PAYE Return |

|

|

Namibia |

PAYE5 Tax Certificate |

If the Fund Name of the employee’s retirement fund was too long, the Fund Name did not display correctly. |

|

Nigeria |

NHF Report |

The report was printing the employee’s Tax Office value instead of the NHF Number. |

|

Rwanda |

Maternity Benefit Declaration |

|

|

Swaziland |

All Reports & Bank Files |

Swaziland reports have been updated to run in multi-user environments. The report name will now save the Site Code and User Number as the prefix of the filename. |

The following new bank files and changes to bank files have been added to the system:

|

Country |

Report |

Detail |

|---|---|---|

|

Kenya |

Eco Bank iBank File |

This bank file is for customers of Eco Bank. The bank file is available from the Kenya Reports Menu. |

|

Zimbabwe |

Barclays Bank File |

Updated bank file to use the employee’s Account Holder Name instead of using the employee’s First Name and Surname. |

|

Zimbabwe |

All Bank Files |

The default currency for all Zimbabwe Bank Files is USD.

If you require the bank file to use the ZWL currency code, you can change the currency from USD to ZWL by selecting the option for “Use a different Currency for Payroll” on the bank file input screen. |